Leading the way toward a sustainable future

Tokenization of carbon credits

Recognizing carbon credits

Permits that allows the owner to emit a specific quantity of carbon dioxide or other greenhouse gases are called carbon credits, or carbon offsets. Because human prosperity and sustainability are directly correlated, we must rethink how we could incorporate sustainable activities, preferences, and considerations into our daily lives.

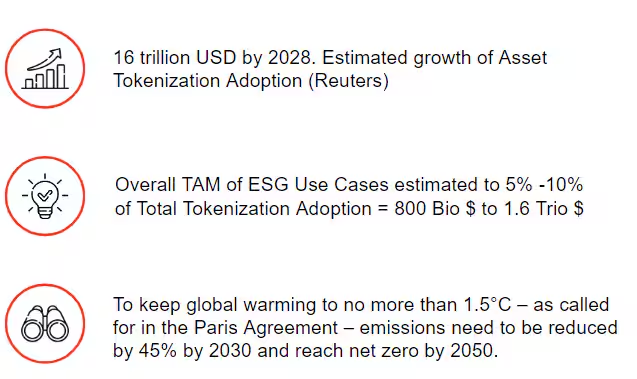

The demand for carbon credits is expected to rise over the next several decades, as this graph shows, underscoring the market’s potential and urgency.

Numbers of carbon credits and tokenization

The Change via Tokenization

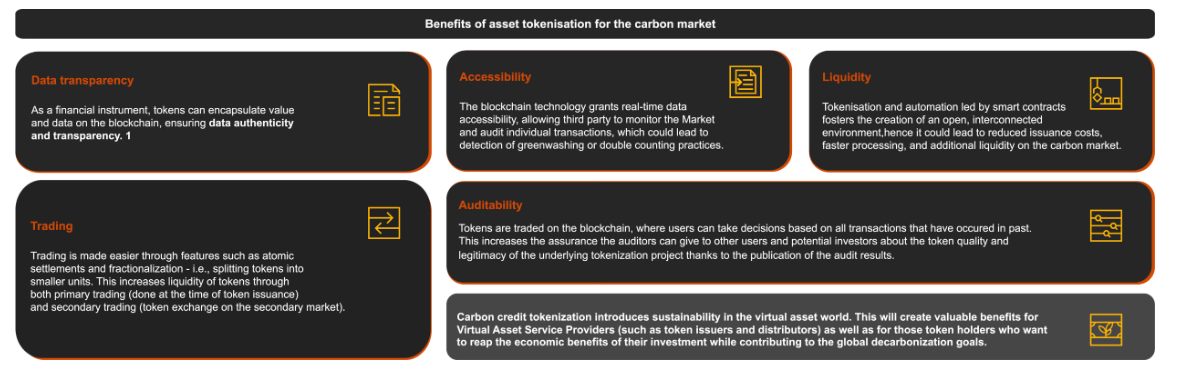

Tokenization improves data traceability and transparency, which makes it a potential solution to the problems of greenwashing and double counting GHG emissions.

The Function of Banks in the Tokenization of Carbon Credits

Banks have a big part to play in the new market for tokenizing carbon credits, and by moving quickly, they can become disruptive forces in the virtual asset market.

Innovation and Market Leadership

Leading this cutting-edge business sets an example for others to follow and shows a dedication to environmental responsibility.

Increasing consumer demand

Early adoption of Carbon Credit tokenization by banks would enable them to meet this demand and draw in a new market of eco-aware customers.

Dedication to addressing climate change

By actively participating in the creation of Carbon Credit tokenization methods, banks may show their dedication to addressing climate change and line with international imperatives.

Tokenized securities represent a new source of income.

Banks can develop new tokenized securities, such green bonds or structured products linked to the tokenized carbon credits, and gain from improved branding and reputation, particularly if concerns about climate change gain traction.

Prospects for the Banks

The development of new financial instruments such as tokenized securities, green bonds, and structured products connected to the tokenized carbon credits is just one of the many options that the tokenization of carbon credits presents for banks.

Creation of Ecosystems

Banks have the chance to build an ecosystem that gives their customers and partners who want to reduce their carbon footprint access to a safe and convenient marketplace. The market would make it possible to effectively assess, purchase, trade, and redeem carbon credits.

Build More Trust

Before tokenizing new tokens and putting them on the network, banks serve as a facilitator by locating reliable and high-quality carbon credit projects. Customers can rely on the bank to conduct due diligence on a number of projects, which eventually lowers the possibility of greenwashing.

Discovery of Prices

Customers will have easier access to liquidity and a better, more transparent price discovery mechanism thanks to the OTC Bulletin Board and/or order books that are available for trading on the primary and secondary markets.

Keep Your ESG Promises

Banks can take advantage of ESG prospects while staying in line with the various pledges made by their boards. Additionally, they can improve their connections with their important clients, who must also meet their own ESG goals.

Innovation in Products

Banks have the chance to develop hybrid financial products like carbon baskets, tokenized structured products, and green bonds thanks to the tokenization of carbon credits. These new products, which are powered by DLT and smart contracts, would be easier to use and provide issuers with a more streamlined process as well as greater portfolio diversification for their clients.

The Network Effect

By forming alliances or partnerships with other banks and businesses looking to get actively involved in the ESG arena, banks can produce a network effect. Additionally, as the ecosystem grows, more high-quality projects will be available.